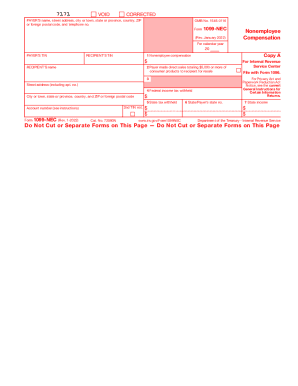

Form 1099-NEC 2023-2024: Tax tips that eliminate headaches

In recent years, the IRS has discovered significant fraud by individuals filing tax returns with numerous refund requests using falsified Forms 1099-MISC. To avoid this, the IRS developed a new policy and extended the deadline for reporting IRS Form 1099-MISC compensation for non-employees to January 31st. At the start of 2023’s reporting year, non-employee compensation will be noted on the newly created Form 1099-NEC. For more details, continue reading.

How To Guide

Follow the quick steps on how to fill out the 1099 NEC in minutes:

- Click Get Form to open it in the editor and start completing it.

- Please note that Copy A is provided for informational purposes only.

- Scroll down to start filling out Copy 1 for the State Tax Department and the following copies for the Recipient and Payer.

- Navigate from one fillable field to another and complete them with the help of the pop-up tips.

- Enter the required information carefully (text, numbers, checkmarks); follow the instructions in the pop-ups.

- For your protection, show only the four last digits of your TIN/SSN. However, the issuer (Client) has already reported your complete TIN to the IRS.

- Double-check the information provided to prevent penalties because of errors.

- Click Done when finished.

- Proceed to send out the report and save Copy B for your records.

What is IRS Form 1099-NEC?

The Internal Revenue Service has reinstituted Form 1099-NEC as a new way to provide data on self-employment income instead of 1099-MISC, as it has done before. Companies will now have to use this template if they have made payments totaling $600 or more to a non-in-house worker, such as an independent contractor.

If you are self-employed, you can expect to receive this new report from a business you have worked with by January 31st of each year and use it to prepare your tax return.

Who needs to submit Nonemployee Compensation?

Any company that makes payments totaling $600 or more to at least one individual who is not an employee will now use this updated form to report that payment. Additionally, businesses will need to complete Form 1099-NEC when they pay any individual at least $10 in fees or when any federal income tax is withheld, regardless of the amount paid for the year.

When is the 1099 NEC due date?

Taxpayers must file their forms no later than January 31, 2024, using paper or electronic methods. Electronic filing is mandatory for those companies that file 250 or more documents. The updated MISC form must be filed in paper form by February 28, 2024, and March 31, 2024, if filed electronically.

1099-NEC vs. 1099-MISC: what’s the difference?

IRS Form 1099-NEC replaces 1099-MISC for non-employees starting in the 2020 tax year. Form 1099-MISC is still used for other purposes, but now, independent contractors have a separate form instead of Box 7 of the MISC-type report.

The complete guide & screenshots on how to prepare the 1099-NEC report

The document itself is straightforward to prepare. You can quickly fill out the blanks online on our website. The main point is to know a few things:

- The form consists of several copies, each of which has its own purpose.

- Copy A is for information only; the official form should be requested from the IRS.

- Copy B and the following pages can be filled in here online, emailed, or printed.

- Copy A for the Internal Revenue Service. It appears in red similar to the official IRS template. The official version of the Copy A is scannable, but the sample from this website is not. It’s provided for informational purposes only.

- Copy 1 for the State Tax Department.

- Copy B is for the Recipient.

- Copy 2 is the sample filed with the recipient’s state income tax return when required.

- Copy C is for Payer.

Fill out the form according to the Instructions for Form 1099-MISC and Form 1099-NEC and General Instructions for Certain Information Returns.

IRS Form 1099-NEC and its components

The Nonemployee Compensation form is relatively short, but it has several copies:

FAQ

What is nonemployee compensation?

These are payments for services provided for your trade or business by those who aren’t employees. Non-employee compensation can include fees, commissions, prizes, benefits, and awards for freelancers’ jobs.

Can I file 1099 NEC online?

You can submit Form 1099-NEC to the IRS by mail or online, using thepdfFiller’s Submit to IRS feature. Check details with the Internal Revenue Service before filing the report.

Where can I get a 1099 NEC form?

To order official IRS information returns, which include a scannable Copy A, visit www.IRS.gov/orderforms. Other fillable copies of the 1099-NEC are available on this website. Go back to the top of the page and click Get Form to start completing your report.

What if you don't file non-employee compensation on time?

If you fail to provide the right form to the right agency before the due date, you will be subject to penalties. The greater the delay in filing, the greater the penalty you will be assessed.

What form should I use 1099 MISC or 1099 NEC?

Use 1099-MISC to report different incomes such as rent, payments to attorneys, or royalties. Payments to non-in-house contractors made in 2023 and later will be reflected on the new Form 1099-NEC. If freelancers work for you, you must provide them with this document by January 31, 2024. If you are a freelancer, you will get this version of the template from your client to prepare your tax return.